Lane, Lane & Kelly Legal Blog

Featured Legal Blog Posts

In today’s fast-paced real estate market, especially across Massachusetts, buyers are moving quickly to secure...

Matthew B. Lane

When a loved one passes away and leaves behind real estate, most frequently the decedent wishes to pass along the home...

Matthew B. Lane

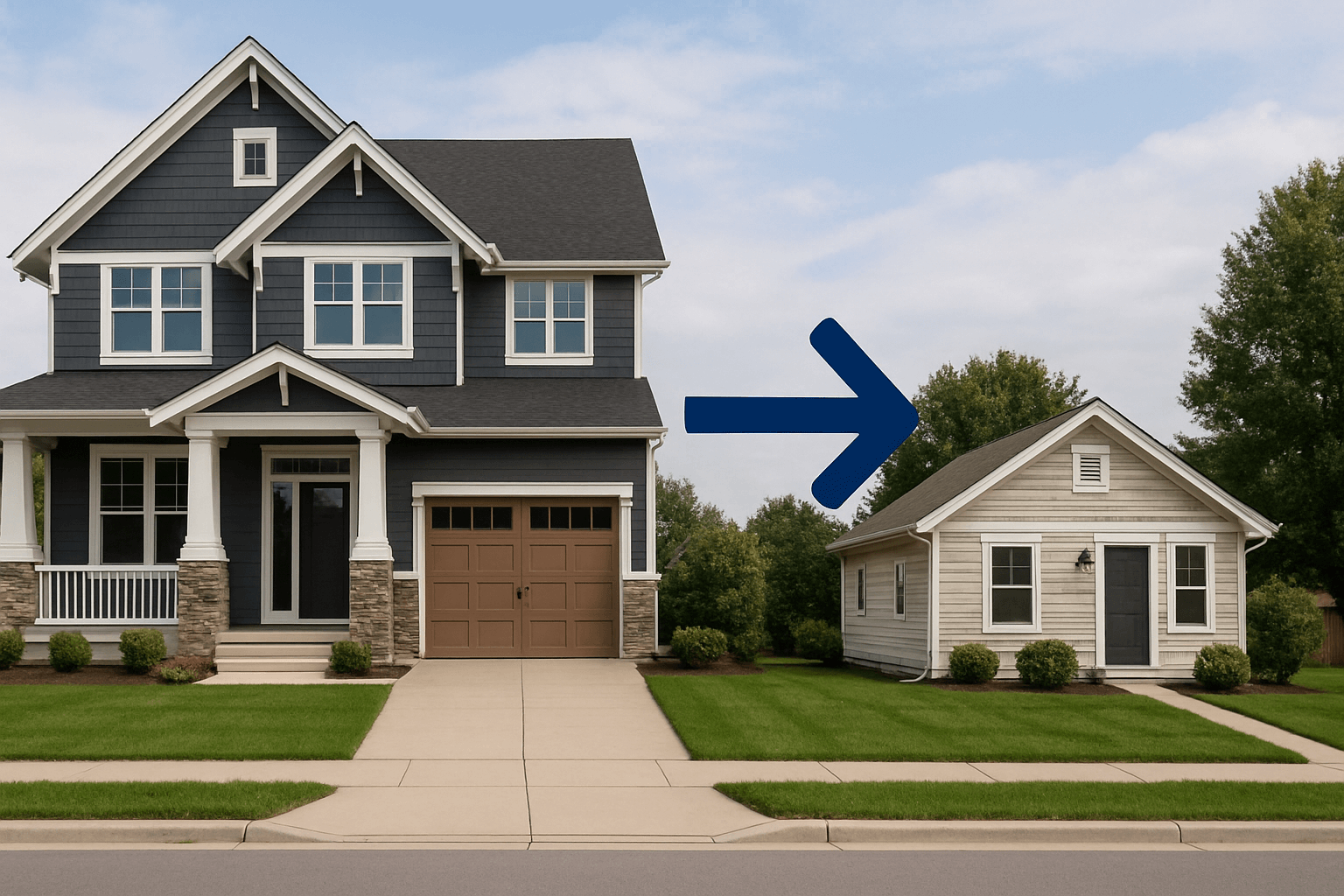

As the spring season of 2025 comes into full bloom, more empty nesters in Massachusetts are reevaluating their housing...

Matthew B. Lane

As cryptocurrency like Bitcoin, Ethereum, Ripple, Litecoin, and other digital assets such as non-fungible tokens (NFTs)...

Matthew B. Lane

For business owners in Massachusetts, estate planning is about more than just personal assets—it’s also about ensuring...

Matthew B. Lane

Selling your home without a real estate agent, commonly known as For Sale by Owner (FSBO), can be an attractive option...

Matthew B. Lane

Creating a Last Will and Testament (Will) is one of the most important steps you can take to secure your future,...

Matthew B. Lane

Buying a home is one of the most significant financial decisions you will ever make. In Massachusetts, the home-buying...

Matthew B. Lane

Buying a home is one of the biggest financial decisions you’ll ever make, and while most buyers focus on the primary...

Matthew B. Lane

When creating a Will or Trust, one of the most critical decisions is selecting who will serve as the Personal...

Matthew B. Lane

Please Subscribe to Our Legal Blog

Leave your email to receive our most recent legal insights straight to your inbox!