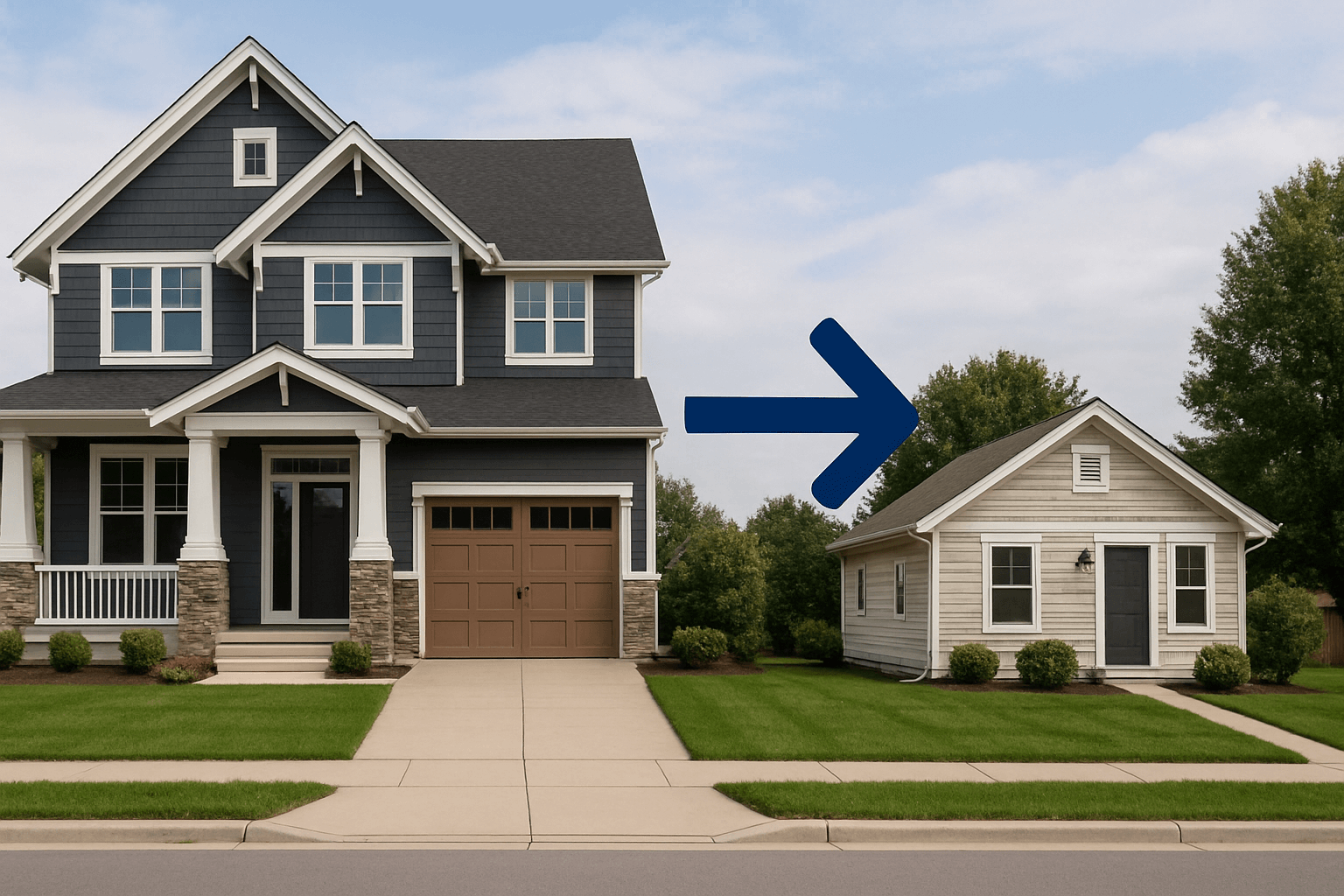

As the spring season of 2025 comes into full bloom, more empty nesters in Massachusetts are reevaluating their housing needs. With children now out of the house and retirement on the horizon, downsizing has become an increasingly popular decision, both for financial and lifestyle purposes. While selling your family home and pursuing something smaller and more manageable can be freeing, it also comes with important legal and tax implications. From capital gains taxes to estate planning strategies, here’s what you should consider before selling your home and making your next move.

Special Nuances to a Purchase and Sale When Downsizing

Downsizing a home isn’t just a lifestyle decision, it comes with several legal nuances that require careful consideration, especially when selling a primary residence and purchasing a smaller property. For example, many downsizing transactions involve the inclusion of furniture in your purchase or the exclusion of certain personal items in the sale, which must be clearly documented in the purchase and sale agreement to avoid future disputes. This makes the selection of a trusted real estate attorney that has experience helping empty nesters with both the sale of their primary residence and the purchase of a new property essential. When selling your family home you may wish to incorporate certain exlcusions, such as family heirloom fixtures (like a chandelier, etc.) that need to be specifically carved out of the transaction. In order to avoid future disputes, these carve-outs must be properly incorporated into the accepted offer and the purchase and sale agreement.

Similarly, when buying a new property, you may be purchasing a home or unit that is fully furnished, or the listing includes at least some furniture or other items in the sale. Special language must be incorporated in your offer and purchase and sale to ensure that your purchase is protected. When it comes to purchasing your next home, many empty nesters seek out smaller homes or condominiums in an effort to avoid general maintenance and upkeep of their property. As a result, there will be condominium and HOA fees that buyers need to be aware of. Additionally, many condominium units have very specific covenants and restrictions as to how the property can be used. These could include restrictions such as external paint colors, whether solar panels are allowed, landscaping rules and regulations, what type of vehicles can be in the driveway, whether pets are permitted, etc. It is important that your real estate attorney reviews the Condominium documents and bylaws prior to your purchase to ensure that you are not restricted from using the property as you intended. A trusted real estate attorney plays a critical role in ensuring that you are adequately informed and protected from unintended legal or financial consequences.

Selling Your Primary Residence: Capital Gains Considerations

One of the biggest financial factors when selling your home is navigating any potential capital gains tax. For many Baby Boomers and older members of Generation X, the family homes that they purchased many years ago, possibly several decades ago, have significantly appreciated in value. Like any other asset that appreciates, real estate gains are subject to capital gains tax. Fortunately, the IRS offers an exclusion for homeowners who have owned and used the property as their primary residence for at least two out of the last five years. This exclusion is codified under IRS § 121 which allows you to exclude from your gross income any amount of gain up to:

- $250,000 for an individual taxpayer;

- $500,000 for married couples filing jointly.

This exclusion keeps money in your pocket that can support you in purchasing a new home, or in funding your retirement.

Should You Gift or Sell Property to Your Children?

Some homeowners consider transferring their home to their children before selling or downsizing. Some homeowners plan to remain at the home with their child(ren), while others that have more financial freedom may look to downsize and gift their home to their child(ren) outright rather than selling it. While gifting real estate to your child(ren) during your lifetime is certainly an option, there would be significant tax implications as a result.

First off, you may trigger your own gift tax liability. In 2025, the annual gift tax exclusion amount is $19,000 per recipient (or $38,000) for a married couple. It is almost a certainty that your Massachusetts real estate would exceed this amount, thus requiring you and your spouse to incur a gift tax on the transfer. While most don’t need to worry about the Federal lifetime gift tax exemption (as it is currently set at $13.99 million in 2025), this gift would also count towards your lifetime exemption amount.

Secondly, upon receipt of the home as a gift, your child would receive the property with its original cost basis (which is the value that you purchased the home for). This will lead to a significant capital gains tax when your child later attempts to sell the home. While simply adding your child to your deed is a very generous thought, you are not only gifting the house, but you are gifting a significant tax bill to your child in the years to come when they ultimately sell. As an example say you purchased your home in 1990 for $100,000 and today it is assessed at $600,000. If you were to add a child to your deed or gift it to them outright, your child would "inherit" your original cost basis of $100,000. As a result if your child then attempted to sell the home, they would incur a $500,000 capital gain and be taxed on it accordingly.

Instead, we recommend working with the experienced estate planning attorneys at Lane, Lane & Kelly to ensure your children benefit from what is known as the “stepped-up” tax basis. For an in-depth overview of the stepped-up tax basis and how you can take advantage of this tax strategy for estate planning purposes, read our full legal blog post here.

The only benefit to adding your child as a joint tenant to your deed or gifting the property to them outright, is that it will allow the property to pass outside of probate upon your death. Probate can be a lengthy, costly, and emotional process, especially when real estate is involved. For a full overview of the Massachusetts Probate process and which assets are subject to probate, please read our legal blog post here. But if your sole purpose for gifting your property to your child or adding them to your deed is to avoid probate, the best option is to incorporate a Revocable Living Trust into your estate plan.

Using a Revocable Trust in the Downsizing Process

If you haven’t already established a Revocable Trust, downsizing is a great time to consider the incorporation of a Trust into your estate plan to protect your new investment where you plan to live out your retirement. A Revocable Trust is a legal arrangement that can accomplish a number of goals for you and your spouse, including but not limited to:

- Avoid the probate court and the entire probate process. This ultimately streamlines the transfer of assets, with the added benefit of keeping information out of the public record and thus securing your privacy;

- Trust agreements protect your assets and can minimize your estate tax;

- You retain full control of the property in the Trust as the Settlor;

- You can revoke or amend the Trust and its terms at any time during your lifetime;

- Trusts allow you to fully control the manner in which your assets and property are held and distributed to your beneficiaries. You can make distributions contingent on your beneficiaries reaching certain ages or achieving certain milestones.

- You can also grant your beneficiaries the right to remain in the property that is being held in Trust, maintain it as a rental property, or grant them a right of first refusal (ROFR) to purchase the property (potentially with the incorporation of a family or friend discount).

- Upon your death or the death of the surviving Settlor, your beneficiaries will inherit the property held in Trust with a stepped-up tax basis, saving them thousands, or potentially even hundreds of thousands, in capital gains tax.

Legal Guidance During the Sale Process

Selling your home, especially one where you raised your family and created lifelong memories, can be emotional and complex. In Massachusetts, a licensed attorney is required to conduct the real estate closing, but working with a trusted law firm such as Lane, Lane & Kelly that has extensive experience in not just real estate transactions, but also with complex estate planning, will ensure that your transaction is handled with care and conducted in the most efficient way possible.

Our team and experienced attorneys at Lane, Lane & Kelly have extensive experience in guiding empty nesters with both the sale of their family home, and the purchase of their next home. We can assist you and your family in the following ways:

- Partner with your broker to review the legal ramifications of any offers on your home;

- Draft, review, and negotiate the Purchase and Sale Agreement;

- Guide you through important tax implications and exemptions with the sale;

- Update or create your estate plan to reflect your new goals as you enter the next phase of your life;

- Ensure smooth property transfers to your children or other beneficiaries that will save them both time and money in the process.

Downsizing isn’t just about moving into a smaller or more maintainable home; it’s a chance to reassess your current financial situation and ensure that you and your loved ones are protected in the future. With trusted legal guidance and thoughtful estate planning, you can maximize the return on investment of your home, protect your assets, minimize taxes, and simplify the transfer of your estate. Don’t trust just anyone with matters that hit so close to home. Voted the Best Law Firm in Braintree and the entire South Shore of Massachusetts, our attorneys are here to help you every step of the way. Contact Us Today and let us help you navigate the legal side of your transition so you can move forward with confidence and the ultimate peace of mind.

This blog is made available for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By reading this blog you understand that there is no attorney client relationship between you and Lane, Lane & Kelly, LLP.

Matthew B. Lane

Matthew is an Attorney at Lane, Lane & Kelly, LLP. Matthew attended Rensselaer Polytechnic Institute obtaining his undergraduate degree in Business & Finance in 2016, graduating with Magna Cum Laude honors, and later graduated from Suffolk University Law School in May 2025 with Cum Laude Honors. Matthew primarily practices in the areas of Estate Planning, Probate & Trust Administration, and Real Estate Conveyancing.