When creating a Will or Trust, one of the most critical decisions is selecting who will serve as the Personal Representative or the Trustee. The Personal Representative is responsible for administering a decedent’s estate after their death, and can either be named in a Will or be appointed by the Court if there is no Will. A Trustee is the person or institution that manages and controls the assets placed in Trust and ensures that the terms of the Trust are properly carried out. The person in this role has a fiduciary duty to act in the best interest of the Will or Trust and its beneficiaries.

While many people consider appointing multiple individuals to share these responsibilities, the decision to name co-Personal Representatives or co-Trustees (“co-Fiduciaries”) often brings about complications that can create delays, disputes, and inefficiencies. This most frequently arises when parents want to select two or more of their children to serve together in these capacities. While this initial logic is well-intentioned, it can result in some major issues down the road. Below we breakdown some of these potential disruptions and outline alternative solutions for you to consider.

Lack of Accountability – Resulting in Delays in Decision Making

Oftentimes when multiple co-Fiduciaries are appointed, one may falsely operate under the assumption that the other one is completing a given task. While I won’t lay it out it here, you know the old adage about assumptions. We frequently see two siblings that are appointed as co-Fiduciaries end up pointing the finger at the other. This can result in feelings of anger and resentment between siblings, where one feels like the other “dropped the proverbial ball” when it comes to completing tasks when administering an estate or managing assets in a trust. During a time where you children are grieving your loss, they are now also anxiety-ridden over whether their brother or sister remembered to pay the electric bill and insurance of your house like they said they would. Inevitably, one sibling always feels like they are doing more than the other and that the other sibling is not carrying their weight. This lack of accountability can create immediate issues between siblings. While your intentions in naming them both were noble, there will be unforeseen consequences that may cause a strain on your children’s relationship. Not only will this impact the family dynamic after you are gone, but it can also cause substantial delays resulting from miscommunications between siblings.

Decision-Making Power

Similar to the lack of accountability between co-Fiduciaries comes the most important part of carrying out an estate, actually making decisions! Co-Fiduciaries have a truly even split when it comes to decision making power. This means every single decision, no matter how miniscule, must be agreed upon by each sibling. This power is specifically outlined in Massachusetts Uniform Probate Code M.G.L.c 190B §3-717 which states in relevant part:

“If 2 or more persons are appointed co-representatives and unless the will provides otherwise, the concurrence of all is required on all acts connected with the administration and distribution of the estate.”

Regardless of how well your children got along during your lifetime, making large-scale financial and legal decisions lead to disagreement. Especially when you factor in the emotional fragility that your children are operating under after losing their parent. This will not only result in delays to the estate administration or distributions of a trust, but it will also eat up your hard-earned assets by the way of attorney’s fees. Your children will inevitably look to their attorney to serve as counselor, and seek their advice at every turn for every decision. Once a disagreement occurs, every decision thereafter is likely to be met with trepidation by each sibling, and likely more disagreement. As a result, simple decisions that could have been made easily, without resistance, had one sibling been named as fiduciary, will now take days or even weeks, and cost your children hundreds or even thousands of dollars in attorney’s fees. While your heart was in the right place naming both children, it is really the attorney that your children select that will be thanking you for naming them both.

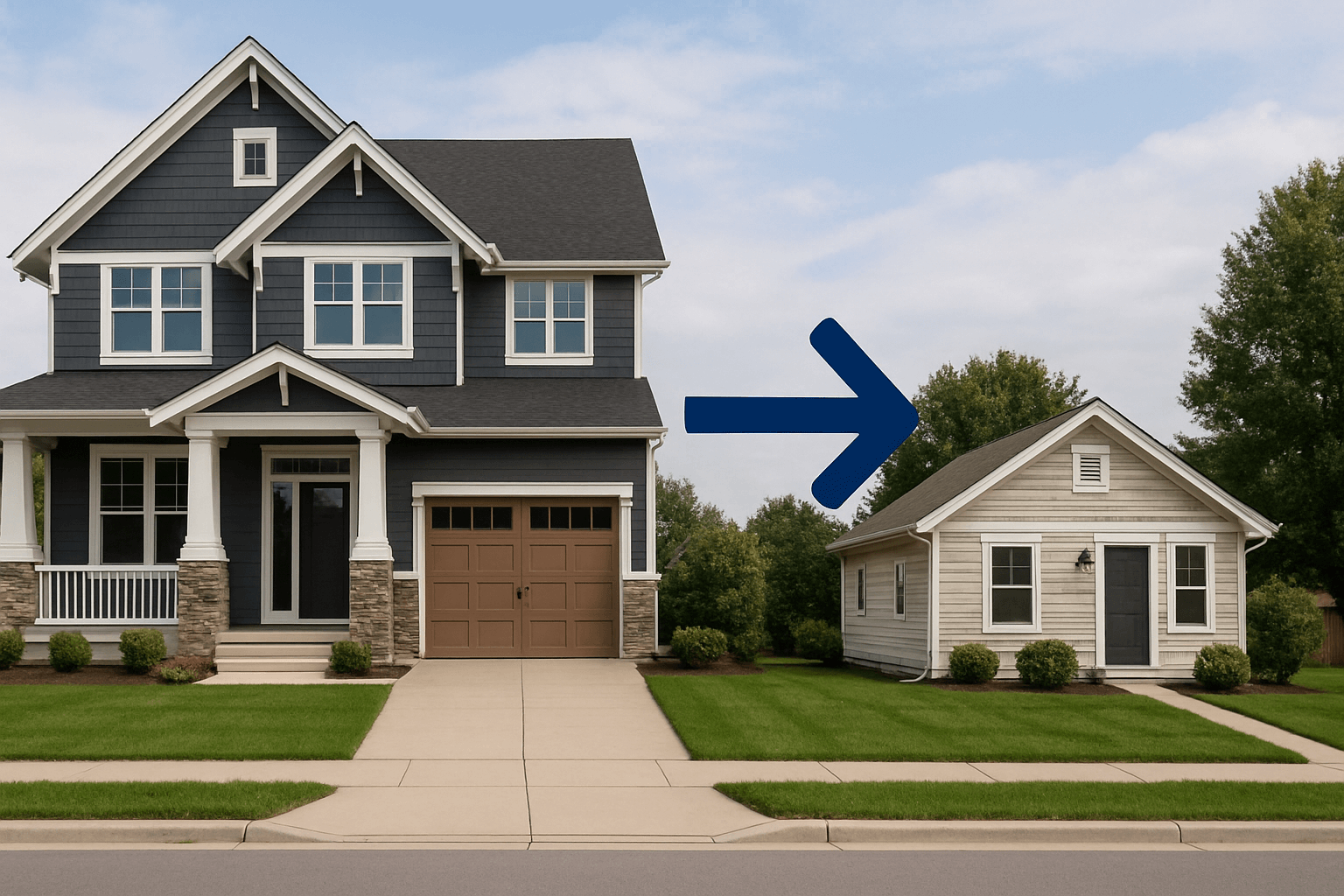

Location Truly is Everything

With the rise of remote work and even some cities and towns providing tax breaks for relocation, it is very unlikely that all children will live in the same state, let alone the same region. Appointing co-Fiduciaries that cannot be physically present at a bank or at their attorney’s office can significantly slow down the probate of an estate. Even for co-Fiduciaries that live in the same area, it is already difficult enough to coordinate around work schedules, childcare or school schedules, and travel schedules. If you add distance into the mix, surely nothing will get done as it relates to managing your estate. We often advise clients that the child living in the same state as you is going to be doing the majority of the work anyways, so why not make it easier on that child and give them full autonomy and power to make any necessary decisions. Naming both children will only cause the in-state child even more headaches, and slow them down significantly. If you name their sibling with them, they now have equal decision-making power and will often object to simple decisions solely because they are far away and feel like they may be missing information, or perhaps because they feel like they are being taken advantage of.

Banks and Courts Don’t Like Co-Fiduciaries

Banks often have reservations about working with co-Fiduciaries due to logistical and legal challenges. For instance, when two or more individuals are named, banks may require all parties to sign checks or authorize transactions jointly, which can slow down the process if one party is unavailable. In terms of authorizing transactions jointly, this typically means that both must be physically present at the bank. As mentioned above this can result in delays and emotional turbulence between your children.

Additionally, Courts prefer one Trustee or Personal Representative because legal issues can arise when co-fiduciaries disagree on a specific decision. As previously mentioned, M.G.L.c 190B §3-717 requires agreement between co-Personal Representatives and is specifically “designed to compel co-representatives to agree on all matters relating to administration when circumstances permit.” (§3-717 Comment 1). But what happens when co-Personal Representatives don’t agree? Disagreements between co-Fiduciaries over estate management and administration can lead to court disputes, further delaying the administration and distribution of assets. Additionally, disputes amongst siblings acting as co-Representatives are not well settled in Massachusetts case law. Meaning that any litigation between siblings would likely be very lengthy barring any settlement agreement, and subsequently very costly. So, who really wins here? Once again, the attorneys that your children hire to represent their own interests when they inevitably cannot agree with one another.

More Disagreement? More Lawyers!

If you’ve found one constant between the aforementioned issues in appointing co-Fiduciaries, it is that attorneys will be the only ones that benefit, not your children. This last issue is every parent’s nightmare coming to fruition. Let’s say you have three children that you have appointed as co-Personal Representatives. Immediately they do not get along and cannot agree on any decisions while administering the estate. What happens?

First off – your children are likely working with your former attorney to aid them in the probate of your estate. This is one attorney (and in an ideal world the only attorney) that is collecting legal fees from your estate. However, if your children disagree, the first thing they will do is hire their own respective attorneys to represent their own personal interests.

Attorneys across the United States are held to a very high standard of ethics, governed by the Model Rules of Professional Conduct. Each individual state then adopts their own Rules of Professional Conduct. Every state will have its own “Conflict of Interest” rule, and in Massachusetts this rule is governed by M.R.P.C Rule 1.7, which states in part:

“a lawyer shall not represent a client if the representation involves a concurrent conflict of interest. A concurrent conflict of interest exists if:

- the representation of one client will be directly adverse to another client.

- there is a significant risk that the representation of one or more clients will be materially limited by the lawyer’s responsibilities to another client, a former client or a third person or by a personal interest of the lawyer.”

This rule gets invoked in a situation where the probate attorney represents the estate, and can no longer represent the children when they are “in conflict” with one another. The probate attorney can continue representing the estate, but they cannot pick a side and represent one individual child. In the above example with three children, they will each have to hire their own individual attorney to represent their interests, while the probate attorney continues to bill the estate for probate-specific legal tasks. Now, your entire estate is really getting eaten up by attorney’s fees – four different attorney’s fees to be exact. Because the estate has yet to be settled and no distributions have been made, each child will pay for their attorney out of their own pocket. But rest assured, once the dust settles, whatever share of your estate they are entitled to receive following any litigation (if any is left!) will simply be reimbursement to your child for the attorney that they hired to fight for their share.

Appointing a Personal Representative and Trustee – Frequently Asked Questions

Question:

If I can only name one person or child, what should I look for when appointing a single Personal Representative, Trustee, or other fiduciary?

Answer:

When evaluating what to look for when appointing your fiduciaries, just remember that you will be forming a PACT with them to carry out your wishes responsibly. As such, just remember the acronym PACT while thinking through your selection.

- P: Proximity – The proximity and closeness of the person to you, your home, your banks, and your beneficiaries, the better the person will be in their capacity as Personal Representative or Trustee. This includes not only geographical proximity, but also the closeness the person has to you and your estate from an emotional standpoint.

- A: Ability – Their competence and responsibility in handling the tasks involved in managing your estate. To avoid delays, make sure you select an individual that is competent with general finances, banking, and has been previously been involved with large-scale transactions (such as buying or selling a home).

- C: Character –Consider their trustworthiness and virtue, making sure that you select someone that consistently acts with integrity. Remember that your Personal Representative or Trustee will have to act with a fiduciary responsibility, which is a high ethical standard. This means they will be obligated to act in the best interests of your estate, rather than their own personal interest. Make sure that you select someone that you know is capable of making these types of difficult decisions.

- T: Temperament – Their maturity and steadiness to handle the duties and any potential conflicts effectively. You need to select someone that is capable of putting their emotions aside when making important legal and financial decisions. If you trust all of your children equally based on the above factors, then most parents will default to selecting their eldest child.

Question:

I’m having a difficult time deciding, what are the worst reasons a client has decided to appoint co-fiduciaries against your advice?

Answer:

1. “My children fought a lot and were not close while I was alive, I believe that appointing them all will help bring them together after I die.”

Unfortunately, these situations seldom play out like the movies. Where your children all return from out of town for your funeral, put their differences aside, and rekindle their relationships while catching up on the past. Appointing all of your children to make significant legal and financial decisions when they already don’t get along to begin with is a fast track to fights, disagreements, more lawyers getting involved, and consequently, more legal fees.

2. “I don’t fully trust any of my adult children, so by appointing them all it will keep them honest and require that they make equitable decisions.”

Another noble decision, that would have disastrous results. If you don’t trust your children to handle your estate properly, then NONE of them should be appointed. Choose a friend, law firm, or bank to act as fiduciary instead. Your children can still be the named beneficiaries without forcing them to act in a fiduciary capacity if they are not fit for it.

3. On the flip side, the one we hear the most often is, “I can’t decide who to appoint because I love and trust all of my children equally, so I am going to appoint them all.”

If you really loved them all equally – then you would name the most legally and financially responsible child based on the above PACT elements to act alone. Otherwise, you really just love attorneys, since they will be the defacto beneficiaries of your estate when your children can’t agree.

Also consider that death and loss can be a heavy burden on your loved ones, specifically your children. Even if your children got along while you were alive, it is certainly possible that you or your spouse were the glue that held the family dynamic together. Your loss may very well be the final straw that brings with it an unintended divide between your children, as they try to navigate a difficult new world without you in it.

Question:

Should I appoint an individual, such as a child, or a professional, such as law firm or bank, to act as the Trustee of my Trust?

Answer:

We have an entire legal blog post designated to this exact question! You can read our full post here: Individual vs. Professional Trustees: Key Factors to Consider in Your Trustee Selection

How Lane, Lane & Kelly Can Help

Choosing co-Fiduciaries can often lead to logistical and legal challenges, potentially causing delays in the administration of an estate. Issues such as a lack of accountability between children, disagreements between co-Fiduciaries and their decision-making power, and the appointment of a fiduciary that resides far away from the decedent can significantly delay the probate process while increasing costs for families. At Lane, Lane & Kelly, we have years of experience guiding parents and families through these complex decisions, ensuring that estate plans are crafted to minimize potential conflicts. For families struggling to finalize who will serve as Personal Representative or Trustee, our firm also has years of experience serving in these roles in a professional capacity, providing a trusted and neutral solution. Let us help you create an estate plan that works smoothly for your loved ones, no matter the circumstances. Contact Lane, Lane & Kelly today to get started and find out why our clients voted us as the Top Law Firm on the South Shore of Massachusetts in 2024!

This blog is made available for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By reading this blog you understand that there is no attorney client relationship between you and Lane, Lane & Kelly, LLP.