Embarking on the journey of estate planning can feel like navigating a complex network of relationships and responsibilities. Behind every well-crafted estate plan lies a cast of crucial players, each with their own role to play in ensuring your wishes are carried out effectively. From the Personal Representative entrusted with executing your Will to the Guardian appointed to care for your minor children, understanding the roles and responsibilities of these key parties is essential to creating a successful estate plan. Below we outline the "Who's Who" of estate planning, highlighting the key roles and responsibilities of all the parties involved in safeguarding your legacy and protecting your loved ones.

Personal Representative

The job of the Personal Representative (formerly known as Executor) is to administer your estate and handle the probate of your estate (if necessary), often assisted by an attorney. The Personal Representative is responsible for collecting the assets, determining and paying debts, filing tax returns, preparing accounts for the estate beneficiaries, filing documents with the Probate Court and distributing the estate assets to the parties named in your Last Will and Testament.

The Personal Representative is a fiduciary and must act in the best interests of the estate beneficiaries. You may designate an individual as sole Personal Representative, or you may have two or more persons acting together. You should list successors to this role, in case the first person is unable to act on your behalf.

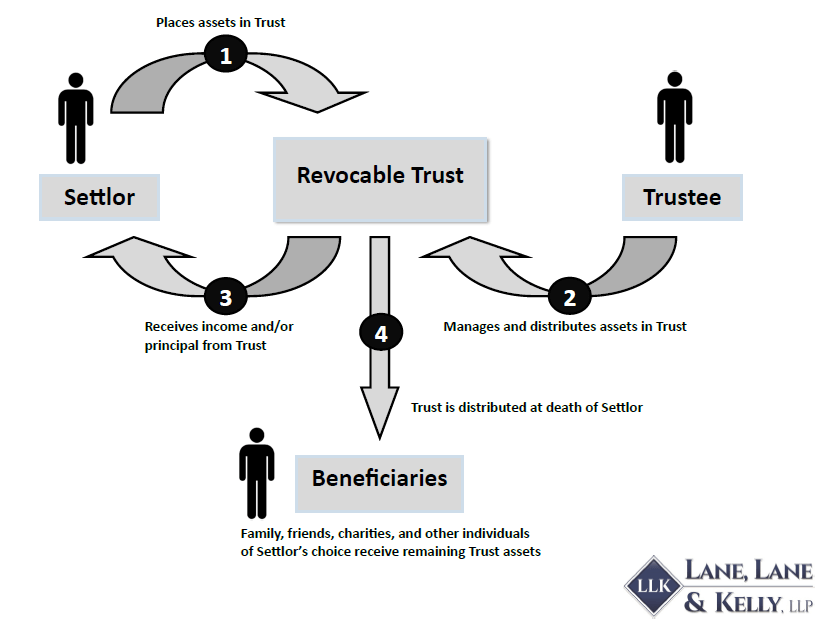

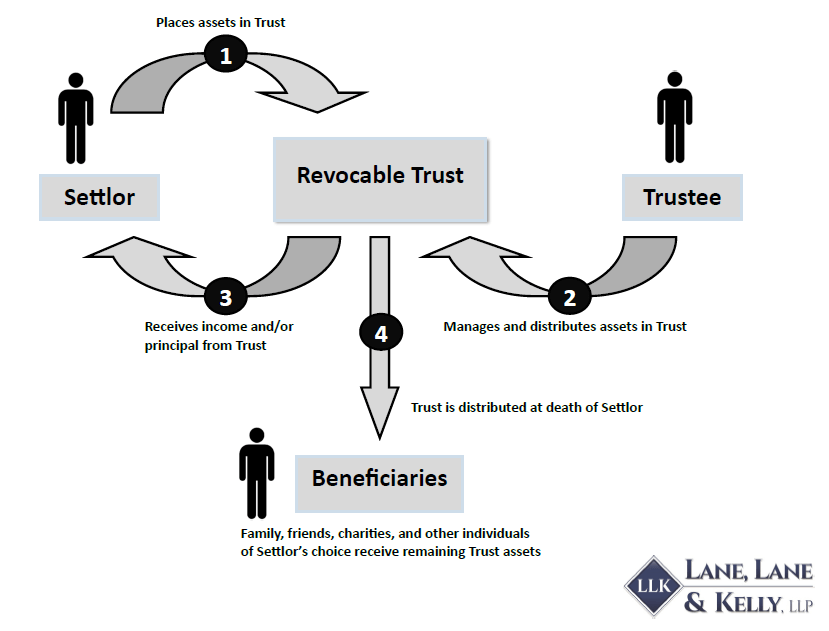

Beneficiaries

A beneficiary is the person or people named to be gifted items, or receive an inheritance, from your estate after you die. For example, if you are married with children, then typically your spouse and then your children would be listed as your beneficiaries. If you are single with no children, you can designate any person, group of people or charities to receive your assets after your death. You can name beneficiaries in your Trust and in your Will.

It is also recommended that you name a successor beneficiary to receive the share of a named beneficiary that predeceases you. For example, if your child were to predecease you then the share he would have received would be paid to his child(ren), or you could choose to have it distributed to your then-living children.

Guardian

If you (and your spouse, if any) die before your child(ren) reach the age of eighteen (18) years, this is the person that will step in to raise your child(ren). He carries out your decisions about where your children live, where they go to school and all other matters regarding everyday living.

Whoever you choose should be willing to step into this role if necessary, so make sure to discuss the possibility with anyone you plan to appoint. You should list at least two guardians in your Will, in case the first person is unavailable or unwilling to take custody if the time comes.

Durable Power of Attorney

This person steps in to make financial decisions for you when you are unable to make such decisions for yourself. This person should be someone you trust to carry out all types of financial decisions such as paying bills and making deposits.

You can choose to appoint one person (individually) or two people (jointly or the survivor of them) to serve in this role. You should designate a successor to your first choice in case they are unable to act on your behalf.

Healthcare Power of Attorney (Healthcare Proxy)

This person steps in to make health care decisions for you if you are unable to make such decisions for yourself. These decisions could range from ongoing care or basic medical decisions to emergency decisions in a life-or-death situation.

You can choose one person at a time to fill this role. You should list a successor in case the first person selected is unable or unwilling to act on your behalf.

Settlor (of a Trust)

The Settlor is the person that establishes the trust (whether a revocable or irrevocable trust). In creating the trust the Settlor legally transfers their rights and control of an asset to the trust itself. In creating (or settling) the trust, the Settlor outlines the terms of the trust instrument, specifically how the trust assets should be held, used, and distributed to the beneficiaries of the trust.

Trustee (of a Trust)

The Trustee is the person or institution that manages and controls the assets placed in trust and ensures that your wishes are followed. The person in this role has a fiduciary duty to act in the best interest of the trust and its beneficiaries.

If you are establishing a revocable trust, you will be the initial Trustee of your trust during your lifetime and designate who should serve as Trustee after your death. You may designate an individual, a professional or an institution, such as a bank, as your successor Trustee and you may have two or more parties acting together as Trustees. For a full overview as to whether you should use a professional or individual trustee, please read our full legal blog here.

The diagram below outlines the parties to a standard revocable (living) trust. This includes the Settlor, the Trustee(s) and the Beneficiaries.

When beginning the estate planning process, it is important to think about the different parties involved and who you can trust with the important decisions that will be made after you pass. Understanding the "who's who" of estate planning is the first step in securing your legacy and finalizing your estate planning documents. Our team at Lane, Lane & Kelly is here to guide you through all of your estate planning needs. With experience dating back to the 1930's, trust our team and our personalized approach to secure your legacy today.

This blog is made available for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By reading this blog you understand that there is no attorney client relationship between you and Lane, Lane & Kelly, LLP.

Matthew B. Lane

Matthew is an Attorney at Lane, Lane & Kelly, LLP. Matthew attended Rensselaer Polytechnic Institute obtaining his undergraduate degree in Business & Finance in 2016, graduating with Magna Cum Laude honors, and later graduated from Suffolk University Law School in May 2025 with Cum Laude Honors. Matthew primarily practices in the areas of Estate Planning, Probate & Trust Administration, and Real Estate Conveyancing.