- Estate Planning

- 11 mins

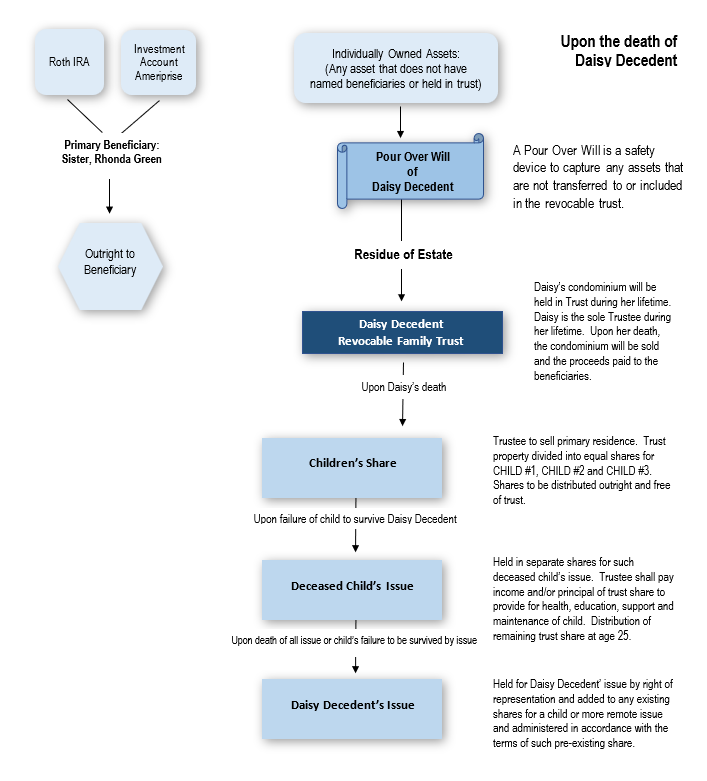

The flowchart below outlines a scenario where the decedent (Daisy) dies with named beneficiaries to her Roth IRA and investment account. Because Daisy had a named beneficiary, these assets transfer to the beneficiary (her sister, Rhonda) immediatley upon her death without the need for probate. Daisy's Will then transfers the residue of her estate (the remander of her real and personal property that was individually owned by Daisy) directly into her pre-established trust. This is called a Pour-Over Will, because it "pours over" or transfers all property that was not already held in the trust. A Pour-Over Will accompanies a living trust, and is designed as a catch all to automatically transfer all of the decedent's remaining assets into the trust. While revocable during Daisy's lifetime, the trust will become irrevocable upon Daisy's death. At which time the successor Trustee named in the trust instrument will take over and distribute the remaining assets to the beneficiaries named in the trust document (Daisy's children in this case). If any of Daisy's children predecease her, then that child's share would be issued to the deceased child's issue (or in plain English, to Daisy's grandchildren - if there are any).

Pros & Cons of a Trust

| REVOCABLE TRUST | IRREVOCABLE TRUST |

| PROs | PROs |

|

|

| CONs | CONs |

|

|

Types of Trusts

While the primary distinction between trusts is whether they are revocable or irrevocable, there are several other types of trusts that can be utilized depending on your unique family needs. Some other types of trusts include:

- Revocable Trust (sometimes referred to as an Inter Vivos or Living Trust): Created and active during the lifetime of the Settlor. These are created during the life of the Settlor where the Settlor can revoke or amend the trust at any time. Many families in Massachusetts will place their primary residence, along with any vacation properties they own in other states, into a Revocable Trust to avoid the need for probate court and to streamline the transfer of their property to their beneficiaries. Below is a sample flowchart highlighting a common plan that utilizes both a Pour-Over Will along with a Revocable Trust.

- Testamentary Trust: Trusts formed after the death of the Settlor. These trusts are built into a Will to create the trust upon the death of the Settlor.

- Irrevocable Income Only Trust (IIOT or often referred to as a Medicaid Planning Trust): An IIOT protects assets from being sold in order to pay for nursing home and other long-term care expenses. MassHealth has strict application requirements, namely that the applicant can have no more than $2,000 in countable assets ($3,000 for a married couple). This type of trust allows the Settlor to protect their assets from future liens, without sacrificing their eligibility status. In doing so, however, the Settlor transfers the assets to the Trust and is prohibited from receiving principle. They are only able to receive income from the Trustee. This type of trust must be irrevocable and is subject to the MassHealth five (5) year look back rule.

- Credit Shelter or Bypass Trust: Massachusetts has its own state-level estate tax. The current exemption amount is set at $2 Million Dollars. This means that if you pass away and have assets that exceed this exemption amount, then your estate will owe taxes to the Commonwealth. Through the use of proactive planning, our team can create credit shelter trusts for you and your spouse with the goal of reducing, or potentially even eliminating any estate tax that would otherwise be due if you failed to plan. Through proper planning, you can ensure that you maximize the amount that your children or other beneficiaries receive, rather than leaving your hard-earned money to the Commonwealth.

- Generation-Skipping Transfer Trust: As the name implies, this type of trust allows grandparents to transfer assets to their grandchildren. In bypassing the prior generation, this trust can help avoid estate taxes. The beneficiaries of the trust must be at least 37.5 years younger than the Settlor.

- Supplemental (Special) Needs Trust: Helps the Settlors ensure that their disabled child is cared for after their death. The Trustee can make payments for the disabled child's health, education, maintenance, and support, without disqualifying the child's government benefits. These types of trusts can also be used when the Settlors wish to leave assets to their children that struggle with drug addiction or have had issues with the law. For a full overview of Supplemental Needs Trusts, their benefits, and why your family may need one as part of your plan, please read our full legal blog here.

- Charitable Trust: This type of trust can be setup in a way to benefit the Settlor, their beneficiaries, and to provide financial support to charities of the Settlor's choosing.

- Pet Trust: For many of us, our pets are a part of the family. Pet trusts set aside financial assets to care for your pet and allow you to name a Trustee that will be responsible for watching over your pet throughout its life. For a full overview of the benefits of a Pet Trust, you can read our legal blog here.

So Where Do I Begin?

At Lane, Lane & Kelly, we're committed to guiding you through every step of the estate planning process with care and expertise. Our Attorneys have extensive experience in creating all of the different types of aforementioned trusts based on your unique needs and estate planning goals. From drafting your Will to setting upthe right type of Trust for you and your family, our experienced team is here to provide the personalized attention and comprehensive support that you deserve.

Start securing your legacy today with confidence, knowing that your future is in capable hands. We recognize that the estate planning process can be complex and difficult to navigate. But with Lane, Lane & Kelly it doesn't have to be.

This blog is made available for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By reading this blog you understand that there is no attorney client relationship between you and Lane, Lane & Kelly, LLP.