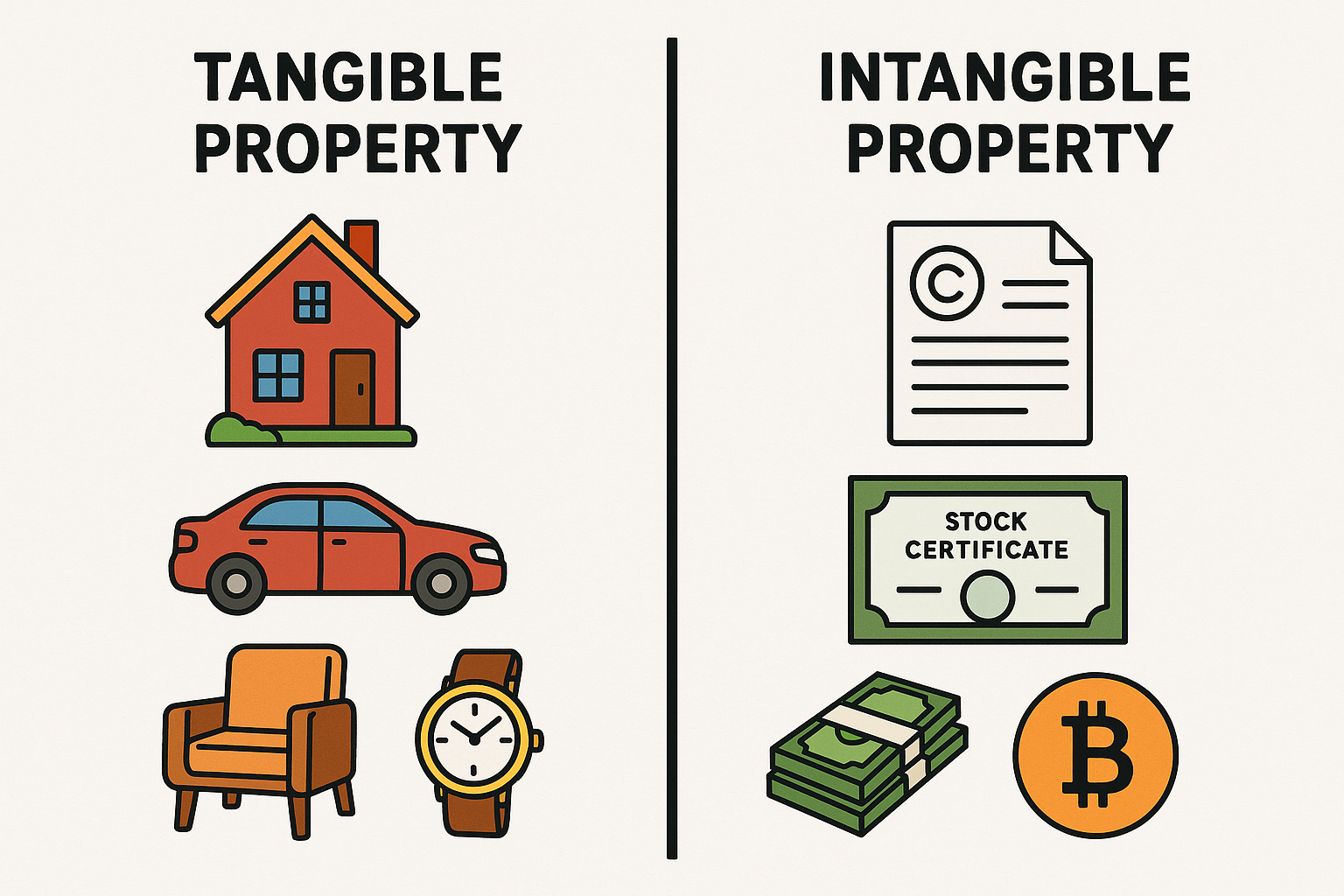

When it comes to estate planning, many people assume that all of their property can be inherited in the same manner. However, when it comes to leaving property in a Will or Trust, not all property is created equal. One of the most important distinctions is between tangible and intangible property. The distinction is important when it comes to your estate plan, because both types of property are distributed differently following your death.

At Lane, Lane & Kelly, we work closely with our clients to ensure that both their tangible and intangible assets are properly accounted for in their estate plan. This ensures that your beneficiaries receive exactly what you intended, leaving no ambiguity or room for second thought. Through legal tools like Wills, Trusts, and Personal Property Memorandums, our team has extensive experience in guiding you through the estate planning process, ensuring that all of your prized possessions and most valuable assets are accounted for.

What Is Tangible Property?

Tangible property includes physical, touchable items. These are things that you can see, hold, or move. These items often carry significant sentimental or personal value, even if their financial value is modest. Common examples of tangible assets include:

- Furniture

- Jewelry

- Art or collectibles

- Antiques

- Clothing

- Baseball card collections

- Watches

- Family heirlooms

There are several approaches to distributing one’s personal, tangible property. If your intent is for all beneficiaries (like all of your children) to share equally in your property, you can specify this in your Will and/or Trust. This method takes the approach of adding up the total value of all tangible assets, and having the beneficiaries share in the value of the sale proceeds. If there are certain items that carry more sentimental value for given beneficiaries, then the estate can partition these assets “in kind” which simply means the beneficiary can take the actual, tangible item, without selling it for value.

Similarly, if some items are of higher value than others or some carry greater sentimental value to a given beneficiary, some estates take the approach of allowing the beneficiaries to do what we refer to as the “draft style” approach. This is where a Will directs all beneficiaries to share in the tangible property equally, without spelling out exactly who should receive each item. All beneficiaries can then go to the primary residence of the decedent at the same time, and conduct a “draft” where they each take turns claiming an item, and they continue until all major items have been claimed and accounted for.

Because tangible items are often deeply personal, and may carry far more sentimental value to someone than they do in monetary value, many people prefer to leave specific instructions naming exactly who they want to receive a given item. One of the most efficient ways to do this is through a Personal Property Memorandum.

What is a Personal Property Memorandum?

Many states, including Massachusetts, have statutory provisions that allow a person to execute what is called a Personal Property Memorandum outside of their Last Will and Testament itself. This is an entirely separate document from your Will that is incorporated into the Will by reference. The major benefit to this document is that it can be updated throughout your lifetime, even years after you legally execute your Last Will and Testament, which has strict execution requirements (for these requirements along with the other major considerations in creating your Will and Trust, click here).

For example, if you own a valuable watch that you want to leave to your nephew, or a family dining table that you want to leave to your daughter, then you can detail these specific bequests in your Personal Property Memorandum.

The ability to create a Personal Property Memorandum is codified in M.G.L. c.190B Article II § 2-513 which states:

“A will may refer to a written statement or list to dispose of items of tangible personal property not otherwise specifically disposed of by the will, other than money. To be admissible under this section as evidence of the intended disposition, the writing shall be signed by the testator and shall describe the items and the devisees with reasonable certainty. The writing may be referred to as one to be in existence at the time of the testator's death; it may be prepared before or after the execution of the will; it may be altered by the testator after its preparation; and it may be a writing that has no significance apart from its effect on the dispositions made by the will.”

Typically, if you wish to make amendments to your Will, you must execute a Codicil. A Codicil is an amendment to your Will that makes additions, edits, or any other subsequent modifications to your current Will. A Codicil does not revoke your previous Will. Instead, it will supplement the existing Will, allowing you to execute the Codicil without the need for creating an entirely new Will, which may be more expensive. A Codicil, however, must be executed in compliance with the same strict execution requirements of a Will.

Accordingly, a Personal Property Memorandum serves a very important purpose, as it allows you to modify the distribution of your tangible property even after your Will is executed, without the need for any other legal assistance. This Memorandum can be modified during your lifetime, and items can be added at any time. Without this Memorandum, then you would have to execute a Codicil or an entirely new Will each and every time you wanted to change who should receive a specific item of tangible personal property, or add a new item and recipient to the list.

Additionally, a Personal Property Memorandum does not have to be filed with the Probate Court in the same way that a Will does. This is a benefit to utilizing the Personal Property Memorandum, because it makes the disposition of your tangible property completely private. Whereas your Will must be filed with the Probate Court during probate administration and becomes a matter of public record, making any distributions or bequests made directly in your Will available to the public to see.

Keep in mind that this Memorandum only applies to tangible personal property. This is why the distinction between asset types become so important as it relates to your estate plan. You cannot use this Memorandum to distribute intangible assets, such as retirement accounts or life insurance policies.

What Is Intangible Property?

Intangible property refers to all non-physical assets. These are your primary financial assets that include things like:

- Bank accounts (Checking and Savings)

- Brokerage accounts, stocks, and bonds

- Retirement accounts (401k, 403(b), pensions, etc.)

- Life insurance policies

- Cryptocurrency (Click here to read our full legal blog post outlining how to account for crypto assets in your estate plan, as the requirements vastly differ from those of traditional financial institutions).

- Business interests

- Intellectual property

The best way to distribute these assets is making and maintaining your Pay-On-Death (POD) or Transfer-On-Death (TOD) designations. All financial institutions allow you to name a death beneficiary, which will transfer the assets in the account directly to the named beneficiary upon your death, without the need for probate. For a detailed overview outlining how to make these beneficiary designations and their importance in your estate plan, you can read our full legal article here which analyzes a recent Massachusetts Superior Court case.

In some circumstances, your intangible assets should be placed into either a Revocable or Irrevocable Trust. Depending on your unique situation, this could be a useful strategy for enhanced creditor protection, or for reducing or possibly even eliminating any Massachusetts or Federal Estate Tax that would otherwise be due when you die. If you are in the process of reviewing your assets and wondering the best way to setup an estate plan to protect yourself and your loved ones, don’t hesitate to contact us today for your free consultation!

Why the Distinction Matters

Understanding the difference between tangible and intangible property ensures that your estate plan accurately reflects your wishes, grants you flexibility to make changes down the road, and ensures that your decisions are legally enforceable.

- For tangible property: Use a Will that incorporates a Personal Property Memorandum by reference for any specific items that you want to leave to particular people.

- For intangible property: Use POD designations to avoid the probate court and streamline the distribution of your assets directly to your named beneficiary. For more advanced estate planning strategies that include other assets, such as real estate or business interests, contact our estate planning attorneys today to discuss the best plan for you.

Failing to distinguish between tangible and intangible property can lead to confusion, family disputes, or unintended distributions after your death. With proper planning, you can ensure that your most valuable and sentimental items are distributed the way you intend, while making the administration of your estate and your assets easier for your loved ones.

At Lane, Lane & Kelly, we guide clients throughout Massachusetts in crafting thoughtful, customized estate plans that address both tangible and intangible assets. If you’re ready to review or update your plan, contact our Award Winning Attorneys today for free a consultation.

This blog is made available for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By reading this blog you understand that there is no attorney client relationship between you and Lane, Lane & Kelly, LLP.

Matthew B. Lane

Matthew is an Attorney at Lane, Lane & Kelly, LLP. Matthew attended Rensselaer Polytechnic Institute obtaining his undergraduate degree in Business & Finance in 2016, graduating with Magna Cum Laude honors, and later graduated from Suffolk University Law School in May 2025 with Cum Laude Honors. Matthew primarily practices in the areas of Estate Planning, Probate & Trust Administration, and Real Estate Conveyancing.